India Inc's limping earnings recovery in March quarter likely to be lopsided

Inflation may continue to weigh on demand without any meaningful improvement in the underlying consumption trends

Corporate earnings in the fourth quarter of FY23 will be lopsided and most of the heavy lifting is likely to made by banking, financial services and the insurance (BFSI) sector companies.

Image: Shutterstock

Corporate earnings in the fourth quarter of FY23 will be lopsided and most of the heavy lifting is likely to made by banking, financial services and the insurance (BFSI) sector companies.

Image: Shutterstock

India Inc continued to cope to safeguard shrinking margins amid stretched balance sheets in the last three months of financial year 2023. Even as demand worries persisted, concerns of high costs crimping margins in an uncertain environment led by increasing interest rates, ballooning inflation and weak global macro situation, remained.

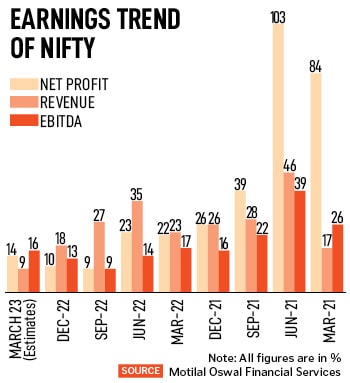

Analysts feel corporate earnings in the fourth quarter of FY23 will be lopsided and most of the heavy lifting is likely to made by banking, financial services and the insurance (BFSI) sector companies. Decline in commodity-led companies, like the metal sector, is expected to be a drag on overall earnings in the quarter.

“The contraction of the Ebitda (earnings before interest, taxes, depreciation, and amortisation) margin has been the sore point for earnings excluding BFSI in FY23 as they have compressed by nearly 300 basis points from peak. However, the pain now seems to be ebbing. The uptick shall depend on demand dynamics. Year over year, autos, pharma and consumer services are likely to turn in maximum margin expansion while cement, power and IT are likely to suffer margin compression,” says Prateek Parekh, equity strategist, Nuvama Group.

Parekh estimates Nifty earnings to grow 13 percent year-on-year (YoY) in Q4FY23 but excluding commodities growth is likely to be higher at over 20 percent (YoY). The slowdown in Nifty earnings is basically due to weak commodity earnings and margin pressures in non-commodity sectors.

Key metal prices declined in the past several months while brent crude has also continued to see a fall in the last three quarters. In the three months ending March, brent crude prices dragged 6 percent, after falling 2 percent in the previous quarter and a sharp slump of 27 percent in the second quarter of FY23.

However, Parekh considers that estimate too at risk as demand deterioration is broadening from exports to some segments of domestic consumption and it will eventually weigh even on credit and capex. According to Parekh, Nifty EPS FY23 is likely to grow 10 percent after a growth of 40 percent in FY22 with commodities as the main drag. “Demand rather than costs are likely to be the key concern in FY24,” he cautions.

However, Parekh considers that estimate too at risk as demand deterioration is broadening from exports to some segments of domestic consumption and it will eventually weigh even on credit and capex. According to Parekh, Nifty EPS FY23 is likely to grow 10 percent after a growth of 40 percent in FY22 with commodities as the main drag. “Demand rather than costs are likely to be the key concern in FY24,” he cautions.